cash app compared to venmo

Cash App charges a 3 fee if you use a credit card to send money but making payments with a debit card or bank account is free. Compare price features and reviews of the software side-by-side to make the best choice for your business.

Cash App Vs Venmo How They Compare Gobankingrates

Yes both Venmo and Cash App have fees.

. Venmo and Cash App let you keep money in your account balance while Zelle does not store it in your account. Zelle does not keep a balance because the funds you receive from the app. 0 for standard deposits and sending money with Cash App balance or linked bank.

The payment wallets allow you to. PayPal charges 29 of each transaction plus 030 for purchases made with a credit or debit card. Quick transfers of money.

No fees Availability through nearly 10000 banks and credit unions in the US. While Venmo allows unverified users to transfer up to 2999 Cash App only allows transfers up to 250. Cash App has a limit of 2000 per day when transferring funds while Venmo allows transfers up to 25000.

This table gives a quick overview of how the two apps compare. The greatest number of people using apps such as Venmo Cash App PayPal Facebook Pay and so on are among the Generation Y cohort. Venmo using this comparison chart.

Other differences between Cash App and Venmo are worth. To simply send and receive money in a C2C way Venmo is the best choice. You probably noticed many of the pros and cons of Cash App vs Venmo are similar.

Zelle offers several advantages compared with Venmo. Venmo in 2022 by cost reviews features integrations deployment target market support. Venmo the latter is the.

The main difference between Venmo and Cash App is that Cash App offers fee-free money transfers while Venmo has a complicated fee structure with many variables. Both apps offer an easy way to make mobile payments to your friends and family. Venmo is our pick if you need to send or accept payments from individuals such as friends but Cash App is a close second.

Whats the difference between Cash App Chime and Venmo. PayPal allows users to create an account using an email while Venmo requires a mobile phone number. So when we compare Cash App vs.

Some 13 of people who have ever used PayPal Venmo Zelle or Cash App say they have sent someone money and later realized it was a scam while a similar share 11. Compare Cash App vs. We recommend downloading more than one payment.

Cash App and Venmo Offer a Physical Cash Card If you want the benefits of a P2P app but still want the security of a debit card Cash App and Venmo have their own debit cards. Venmo charges 3 per transaction for purchases made with a credit card and no fee for debit card purchases. To invest in stocks or Bitcoin or get fast easy direct deposits Cash App is a better option.

Compare Cash App vs.

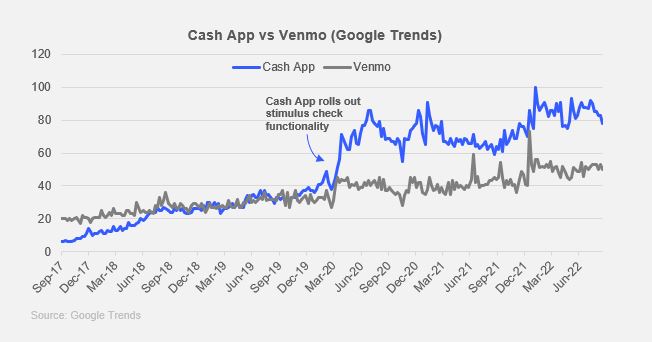

Cash App And Venmo See Growth Spike As They Move Closer To Traditional Banking

Zelle Vs Venmo What To Know About Security On Cash Sending Apps Cleveland Com

Cash App Vs Venmo Battle Of The Brands By Mention

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

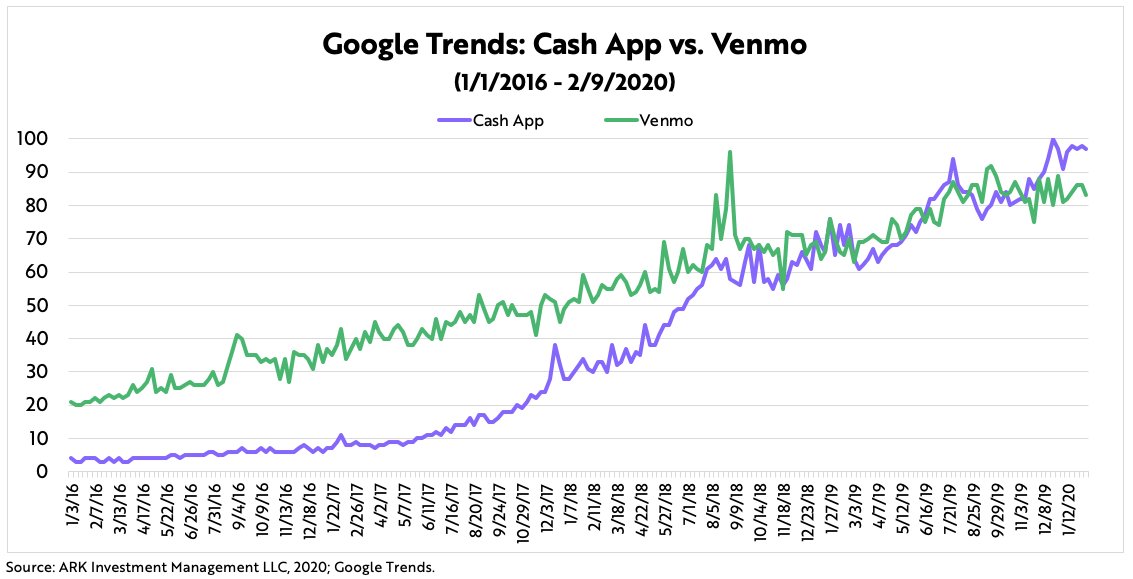

Why Square Is Attractive Even At All Time Highs Nyse Sq Seeking Alpha

Cash App Vs Venmo Battle Of The Brands By Mention

Cash App Vs Venmo 2022 Comparison Pros Cons

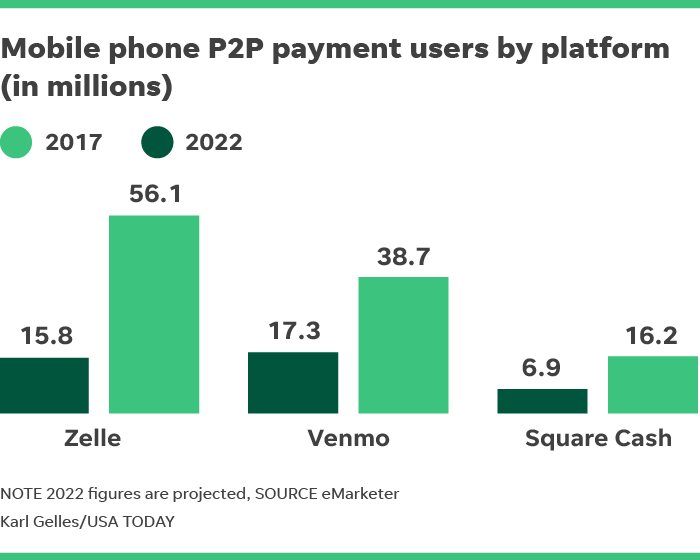

What Are The Top 3 Mobile Peer To Peer Payment Platforms In The Us

Venmo Vs Square The Most Popular Us Consumer Finance Products

Rex Woodbury On Twitter 1 Cash App Overtook Venmo By Embedding Itself In Culture And By Targeting All Of America Not Just Nyc Sf And La Over 200 Hip Hop Artists Have Name Dropped

Venmo Will Have New Service Fees But You Have To Opt In Ktvb Com

How To Transfer Money From Venmo To Cash App

Lessons From Cash App Why Turning Commerce Into Culture Is By Ana Andjelic Medium

Venmo Paypal And Cash App Will Now Have To Report Transactions Totaling More Than 600 To The Irs Daily Mail Online

Cash App Vs Venmo Which One Should You Choose

Cash App Vs Venmo Forbes Advisor

/images/2022/02/08/cash-app-and-venmo.jpg)

Cash App Vs Venmo 2022 How Do They Compare Financebuzz