child tax credit number

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. You can be paid more if your child has a disability.

Advance Payments Of The Child Tax Credit The Surly Subgroup

This depends on things like whether you pay for childcare and the number of children you have.

. Call this IRS phone number to ask about child tax credit payments Your Social Security number or Individual Taxpayer Identification Number ITIN Your birth date Filing status. This is an up to 1400 per. 1-800-829-1040 Regardless of the state you live in the IRS representatives are available Monday through Friday.

Already claiming Child Tax Credit. The Child Tax Credit Update Portal is no longer available. 44 2890 538 192.

The amount you can get depends on how many children youve got and whether youre. Employees Withholding Certificate. Not have turned 18 before January 1 2022.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. In addition to missing out on monthly Child Tax Credit payments in 2021 a failure to file in 2020 could mean losing out on other tax benefits or a refund you were owed. IRS TREAS 310 CHILDCTC.

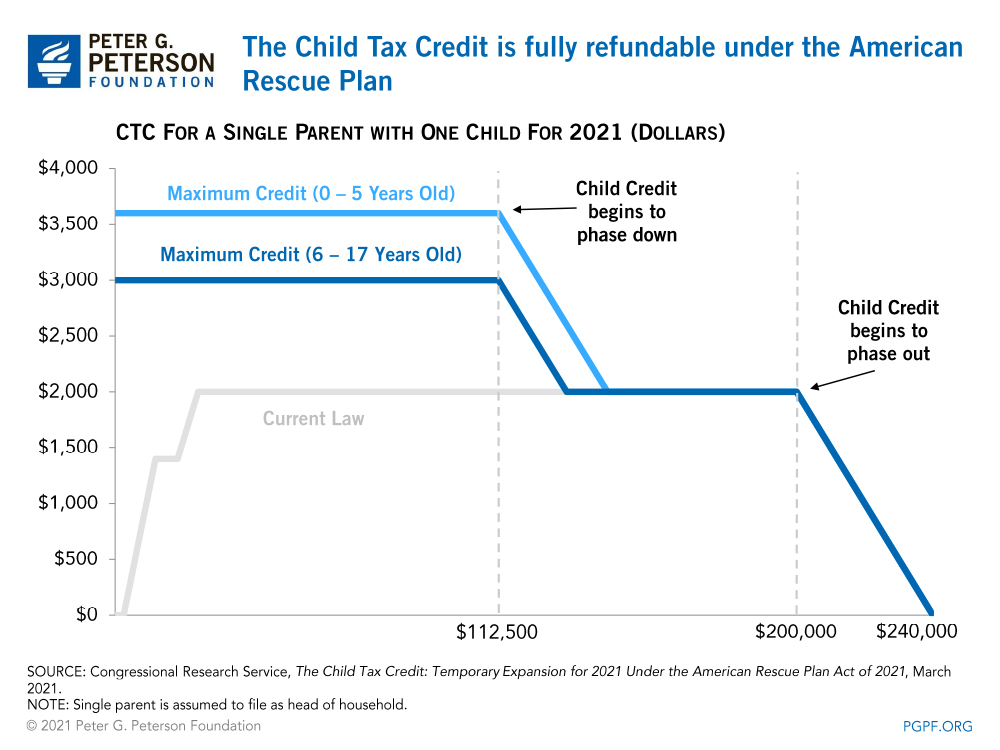

Request for Transcript of Tax Return Form W-4. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. You can also claim.

Dial 18001 then 0345 300 3900. The credit amount was increased for 2021. Generally to be eligible for the Earned Income Tax Credit you must.

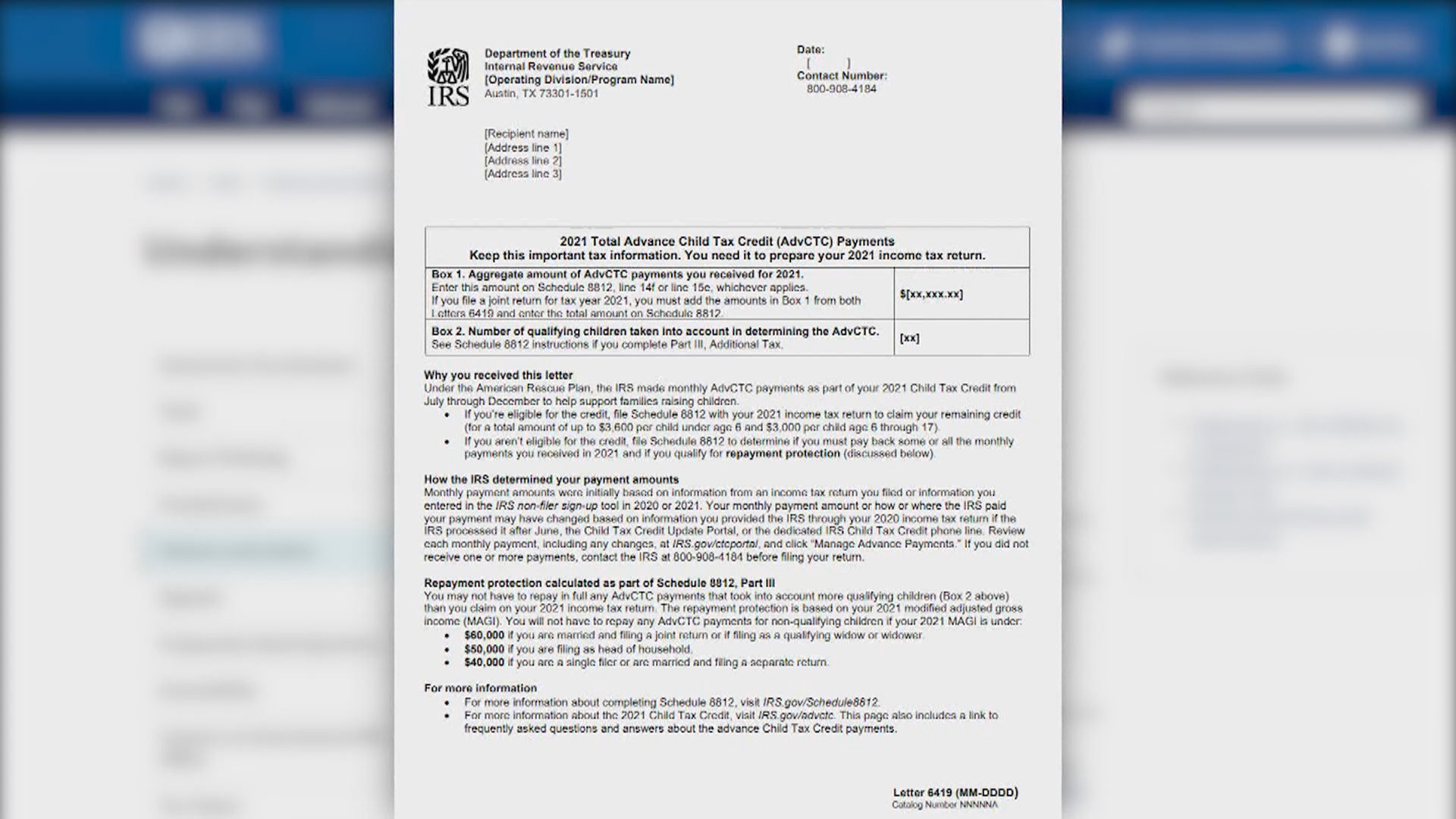

This is a 2021 Child Tax Credit payment that may have been received monthly between July and December. Or an IRS Individual. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

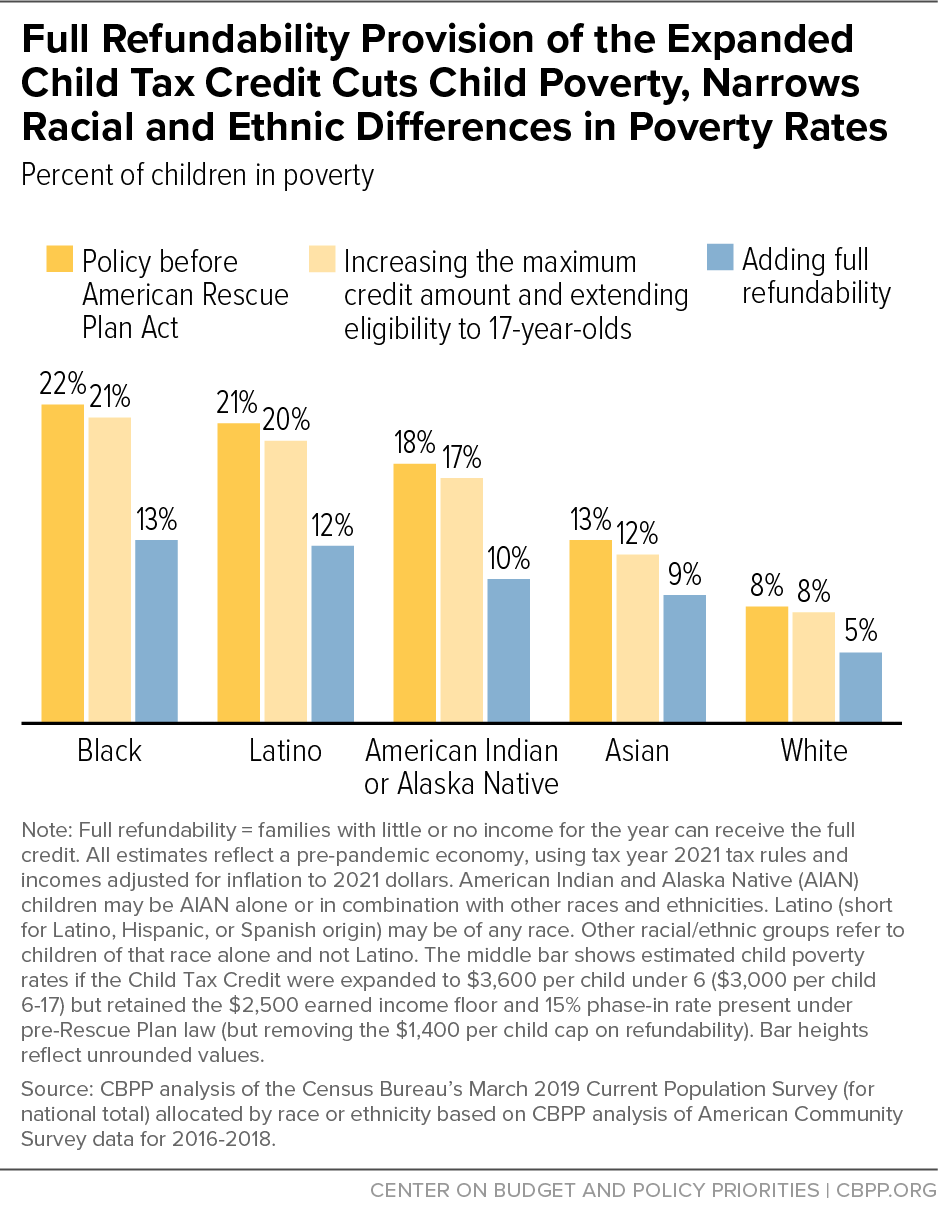

Be your own child adopted child stepchild or foster child. You can also use Relay UK if you cannot hear or speak on the phone. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. The first phaseout can reduce. One of the changes with tax reform is that children are now required to have an SSN by the due date of their return to be qualifying children for the CTC and the ACTC.

This rule is effective for. Have earned income through work during 2021. Use the GOVUK tax.

There are basic eligibility rules that apply to most everyone. Contact information child and family benefits Benefits enquiries line Call 1-800-387-1193 Alberta benefits enquiries Call 1-800-959-2809 Canada workers benefit Call 1-800-959-8281. IRS TREAS 310 TAXEIP3.

Department of Revenue Services. Call the IRS about your child tax credit questions from the below phone number. Making a new claim for Child Tax Credit.

The Child Tax Credit is reduced phased out in two different steps which are based on your modified adjusted gross income AGI in 2021. HOLIDAY - The Department of Revenue Services will be closed on Monday October 10 2022 a state. For your children to qualify you for a Child Tax Credit they must.

Connecticut State Department of Revenue Services.

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Will You Have To Repay The Advanced Child Tax Credit Payments Wkbn Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

Child Tax Credits Causing Confusion As Filing Season Begins

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

How The New Expanded Federal Child Tax Credit Will Work

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

2021 Advanced Child Tax Credit What It Means For Your Family

Tax Tip Tool Available To Track Your Advance Child Tax Credit Payments Taxpayer Advocate Service

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

2020 Tax Filing Will Determine Child Tax Credit Periodic Payments In 2021 Early Childhood Alliance

The Child Care Tax Credit Is A Good Claim On 2020 Taxes Even Better For 2021 Returns Don T Mess With Taxes

Child Tax Credit What We Do Community Advocates

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Cheats Kirtland Federal Credit Union

You Got Your Last 2021 Advance Child Tax Credit Payment Now What Don T Mess With Taxes

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy