wyoming tax rate lookup

With local taxes the. This is the total of state county and city sales tax rates.

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Depending on local municipalities the total tax rate can be as high as 6.

. Use this search tool to look up sales tax rates for any location in Washington. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Your 2021 Tax Bracket To See Whats Been Adjusted.

Delivery charges both shipping and handling are subject to sales tax in Wyoming. Wayfair Inc affect Wyoming. Analysis from Leading Practitioners and the Resources You Need to Make Informed Decisions.

The average property tax rate is only 057 making Wyoming the lowest property tax taker. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6. Assess value and allocate public utility property.

BSA Software provides BSA Online as a way for municipalities to display information online and is not responsible for the content or accuracy of the data herein. 2022 Wyoming state sales tax. Exact tax amount may vary for different items.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. Counties in Wyoming collect an average of 058 of a propertys assesed fair market value as property tax per year. The Cheyenne sales tax rate is.

Residential property is assessed at 95 of market value. As well as to administer collect and distribute designated taxes in accordance with Wyoming Statutes and Rules for the benefit of Wyoming. Ad Compare Your 2022 Tax Bracket vs.

Each states tax code is a multifaceted system with many moving parts and Wyoming is. On the left hand side of the screen click on Tax Information Search. Tax amount varies by county.

Wyoming also does not have a corporate income tax. Click the link below to access the Tax Bill Lookup. This is the total of state county and city sales tax rates.

The base state sales tax rate in Wyoming is 4. Wyoming has one of the lowest median property tax rates in the United States with only eleven states collecting a lower. The Wyoming WY state sales tax rate is currently 4.

181 rows Wyoming Sales Tax. This data is provided for reference only and WITHOUT WARRANTY of any kind expressed or inferred. Ad Bloomberg Tax Expert Analysis Your Comprehensive Wyoming Tax Information Resource.

Search results will be listed click on the parcel number in blue next to the correct record. The Wyoming sales tax rate is currently. The minimum combined 2022 sales tax rate for Bill Wyoming is.

The mission of the Property Tax Division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000. The County sales tax rate is.

To calculate sales and use tax only. Use this search tool to look up sales tax rates for any location in Washington. Please contact your local municipality if.

Enter your search criteria either last name address or parcel number. The Bill sales tax rate is. Wyoming ranks in 10th position in the USA for taking the lowest property tax.

Groceries and prescription drugs are exempt from the Wyoming sales tax. Wyoming sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. ZIP--ZIP code is required but the 4 is optional.

There are a total of 106 local tax jurisdictions across. Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external collection agency. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

The minimum combined 2022 sales tax rate for Cheyenne Wyoming is. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Prescription drugs and groceries are exempt from sales tax.

State wide sales tax is 4. Should you collect sales tax on shipping charges in Wyoming. Did South Dakota v.

The state sales tax rate in Wyoming is 4. 31 rows The state sales tax rate in Wyoming is 4000. Find your Wyoming combined state and local tax rate.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. To calculate sales and use tax only. Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2.

Wyomings gas tax is fever than average at 23 cents per gallon. ZIP--ZIP code is required but the 4 is optional. The Wyoming sales tax rate is currently.

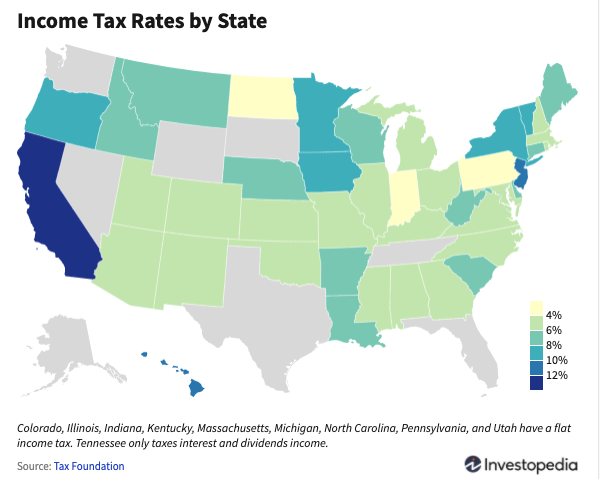

Wyomings tax system ranks 1st overall on our 2022 State Business Tax Climate Index. The County sales tax rate is. In Cheyenne for example the county tax rate is 1 for Laramie County resulting in a total tax rate of 5.

The use tax is the same rate as the tax rate of the county where the purchaser resides. Discover Helpful Information And Resources On Taxes From AARP. Wyoming ranks 7th nationally for the lowest average sales tax state and local rates are included only 539.

Residential market value 100000 Residential assessment rate 95. Taxable value is the value used to calculate taxes due on your property. Average Sales Tax With Local.

Tax Bill LookupPayment Instructions. See the publications section for more information. The tax history will be located at the bottom of the page you.

Wyoming Business License License Search

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

Wyoming Property Tax Calculator Smartasset

Wyoming Sales Tax Rates By City County 2022

Wyoming Sales Tax For Photographers

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Historical Wyoming Tax Policy Information Ballotpedia

What Is Sales Tax Nexus Learn All About Nexus

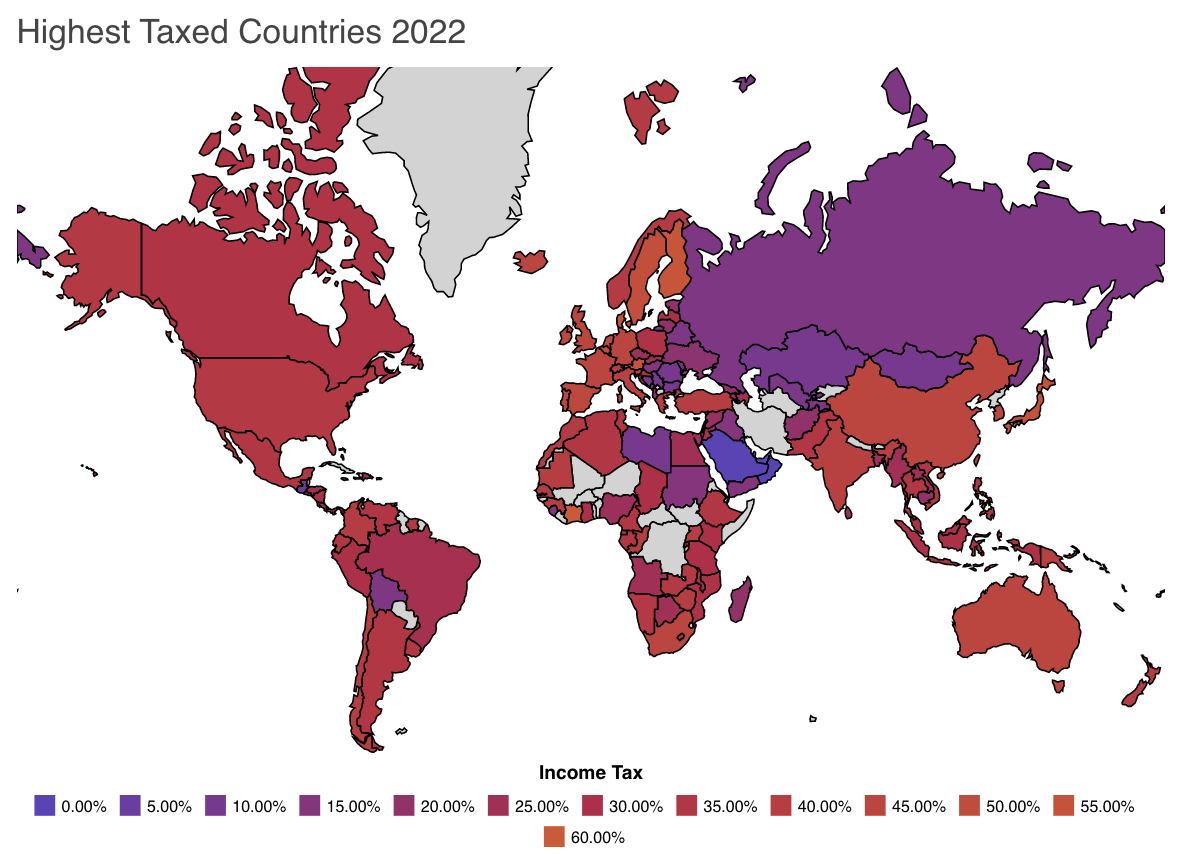

Qod Order Countries By Tax Rates United States Germany Mexico Blog

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Qod Updated How Many States Do Not Have State Income Taxes Blog